Universal Life Insurance: A Smart and Flexible Way to Secure Your Future

Universal Life Insurance is more than just a policy. It is a long-term financial strategy designed to provide peace of mind and the opportunity to build wealth over time. If you have ever wondered whether your life insurance plan is flexible enough to grow with your changing needs, Universal Life Insurance might be the answer you have been searching for.

This guide walks you through what makes Universal Life Insurance unique, how it works, and why so many people are choosing it as part of their long-term financial planning.

What Is Universal Life Insurance?

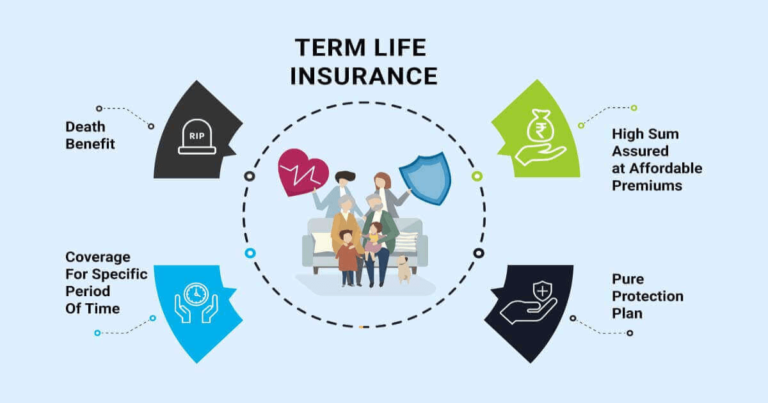

Universal Life Insurance is a type of permanent life insurance that provides lifelong coverage along with a cash value component. Unlike term life insurance, which only covers you for a set period, Universal Life does not expire as long as you keep up with the required payments. What sets it apart is flexibility. You can adjust your premiums and death benefits over time and build a cash value that you may borrow or withdraw from under certain conditions.

Key Features of Universal Life Insurance

Universal Life Insurance stands out because of its unique features. Let’s look at them more closely.

Flexible Premium Payments

You are not tied to a rigid premium schedule. You have the option to pay more when you can and less when times are tight. If your cash value is strong enough, it can even cover your premiums during difficult financial periods. This level of control makes the policy more adaptable to real-life ups and downs.

Adjustable Death Benefits

Life changes, and so do your financial obligations. With Universal Life, you can increase your death benefit if your responsibilities grow, such as when you buy a home or start a family. On the other hand, you can reduce the death benefit later in life to lower your premiums. This makes the policy especially useful for people whose financial needs shift over time.

Cash Value Accumulation

Part of the money you pay goes into a cash value account that grows over time. The insurance company adds interest to this account, either based on current market conditions or a guaranteed minimum rate. The best part is that the cash value grows on a tax-deferred basis. You can use it for major expenses such as college tuition, a down payment on a house, or even emergencies. Loans or withdrawals are also possible, giving you greater financial flexibility.

Lifelong Coverage

Unlike term insurance, which ends after a set number of years, Universal Life lasts for your entire lifetime as long as there is enough value in the policy to cover costs. This guarantees that your loved ones will be financially protected no matter when you pass away.

Tax Advantages

Universal Life also comes with tax benefits. The death benefit is usually passed on to your beneficiaries free of income tax. Meanwhile, the cash value grows tax-deferred, allowing your money to compound without being reduced by yearly taxes. Withdrawals may also be tax-free up to the amount you have paid in premiums.

How Universal Life Insurance Works

Think of Universal Life Insurance as a mix between a term policy and a savings account. Every premium you pay is split between the cost of insurance and your cash value account. Interest is applied to the cash value, which can grow steadily over time.

You can choose how to structure your death benefit. With the level death benefit, your beneficiaries receive a fixed amount, while the cash value builds quietly in the background. With the increasing death benefit, your beneficiaries get both the original face amount of the policy plus the accumulated cash value. This option costs more but is attractive to people who want to leave behind a larger legacy.

Benefits of Choosing Universal Life Insurance

Universal Life Insurance combines life coverage with financial flexibility, making it a versatile option for those who want more than a traditional policy. Unlike term life, which expires after a set period, or whole life, which locks in premiums, Universal Life adapts to your changing needs. It allows you to protect your loved ones while building a financial resource that can be used for multiple purposes over time.

Flexibility to Adapt as Life Changes

Life rarely follows a straight path. Careers evolve, families grow, and unexpected expenses arise. Universal Life allows you to adjust your premiums and death benefit to match your current situation. For example, if you receive a promotion or bonus, you can increase payments to grow your cash value faster. Conversely, if financial challenges arise, you can temporarily reduce premiums without losing coverage. This flexibility makes it a practical choice for people with dynamic lives, changing responsibilities, or uncertain income streams.

Building Wealth Over Time

One of the standout features of Universal Life Insurance is the cash value component. This portion of your policy grows over time, similar to a savings account, and earns interest while you remain insured. The cash value can serve as a financial cushion for major life events. Whether you are thinking about funding a child’s college education, handling an unexpected medical bill, or creating a supplemental retirement fund, Universal Life provides options that term life policies simply cannot offer. What this really means is that your insurance policy is not just protection; it becomes a financial tool that grows with your life.

Estate Planning and Legacy

Universal Life is also highly valuable for estate planning. The death benefit can cover estate taxes, which can otherwise force heirs to sell property or assets under pressure. Policies can be structured to pass on wealth efficiently, preserving your legacy for children, grandchildren, or even charitable organizations. For example, parents can ensure their children inherit a tax-efficient sum without depleting other savings, and business owners can secure funds for succession planning. Universal Life provides a way to leave more than just memories. It allows you to leave a tangible, well-planned financial legacy.

Supplemental Retirement Income

Another key advantage of Universal Life Insurance is its potential to supplement retirement income. As your cash value grows, you can borrow against it, providing access to funds without going through traditional loan processes. This can be especially useful if unexpected expenses arise during retirement or if your other retirement accounts are temporarily underperforming. Using cash value in this way allows you to maintain your lifestyle, cover emergencies, or fund opportunities like travel or home renovations, all while keeping your family protected.

Emergency Access

Life can throw curveballs when you least expect them. One of the benefits of Universal Life is the accessibility of its cash value. Unlike high-interest loans or credit cards, you can access funds from your policy quickly and efficiently. While borrowing reduces the death benefit if unpaid, it offers a convenient and often cost-effective alternative to other forms of emergency funding. Think of it as having a safety net built into your life insurance, one that you can tap into without complicated approval processes.

Why Universal Life Stands Out

Not all life insurance policies are created equal. Term life insurance is affordable and simple, but it does not build cash value and expires after a fixed period. Whole life insurance guarantees lifelong coverage and builds cash value, but premiums are fixed and may not suit people with changing financial situations. Universal Life sits in between, offering the protection of permanent insurance while giving flexibility and growth potential. It is particularly useful for individuals who anticipate changes in their financial situation or want a policy that evolves with their long-term goals.

Making Universal Life Work for You

To maximize the benefits of Universal Life, planning is key. Consider your financial situation, long-term goals, and risk tolerance. A well-structured policy involves determining the right death benefit, premium schedule, and strategy for growing cash value. Working with a qualified financial advisor can help ensure your policy adapts to life changes, whether it is the birth of a child, a career shift, or preparing for retirement. Regularly reviewing your policy ensures it continues to meet your needs and provides the intended protection and financial opportunities.

Examples of How Universal Life Can Help

A couple with young children might want to ensure college tuition is covered. By contributing slightly more to their Universal Life policy, they can build a cash value that may be borrowed against when their children are ready for college. Another scenario involves a business owner who wants to secure their company’s future. The policy’s death benefit can fund a buy-sell agreement, ensuring the business remains operational if one partner passes away. These examples illustrate how Universal Life can be both protective and strategic, serving multiple purposes in one policy.

Is Universal Life Insurance Right for You?

This type of policy is not for everyone. It tends to be best for people who want lifelong coverage, appreciate flexible payments, and like the idea of combining insurance with savings. It is also attractive to those with variable income or those who anticipate significant life changes, such as starting a family or changing careers.

Common Misconceptions About Universal Life Insurance

Many people hesitate because of common myths. Some think it is too expensive. While it costs more than term insurance, the added value of cash growth and flexibility often justifies the price. Others believe they will not need it for life, but Universal Life can serve purposes beyond supporting dependents, such as leaving a legacy or covering final expenses. Some assume they can invest better on their own, but Universal Life builds savings automatically and grows on a tax-deferred basis. Another misconception is that you cannot access the money, but loans and withdrawals are available, provided you manage them carefully.

Key Considerations Before Buying

Before making a decision, make sure you fully understand the details. Review the fees and administrative costs, and check how interest is credited to your policy. Remember that if your cash value drops too low and you do not make additional payments, your policy could lapse. Always choose a reputable insurance company with a solid track record. Finally, review your policy each year to confirm it still aligns with your goals.

Is Universal Life Insurance Worth It?

Universal Life Insurance is one of the most versatile financial tools available. It offers lifelong protection, the ability to adapt your policy over time, and the chance to grow cash value that supports your long-term financial stability. If you want a policy that not only protects your family but also adapts with your life and builds wealth, Universal Life Insurance deserves serious consideration.

Conclusion

Universal Life Insurance is more than just a safety net. It combines life coverage with flexibility, cash value growth, and estate planning advantages. By managing your policy thoughtfully, you can protect your loved ones, create financial opportunities, and plan for a secure future. Unlike traditional policies that offer protection only, Universal Life allows you to adapt, save, and prepare for both expected and unexpected events. It is a tool that grows with your life, offering peace of mind today and financial options for tomorrow.

If you are ready to see whether Universal Life Insurance fits your financial plan, talk to a trusted advisor. Compare policies, weigh your options, and choose a plan that supports your long-term goals. With the right approach, Universal Life Insurance can become more than just a safety net. It can be the cornerstone of lasting financial security for you and your family.