Term Life Insurance: The Affordable Way to Protect What Matters Most

When you think about protecting your loved ones financially, term life insurance often comes up as one of the most straightforward and affordable ways to do it. Whether you are a new parent, a homeowner with a mortgage, or simply someone who wants to make sure your family is financially secure if the unexpected happens, term life insurance can be a smart move.

But how does term life insurance really work? What does it cover? Is it right for everyone? This post breaks down everything you need to know in simple, practical terms so you can make the right decision for your financial future.

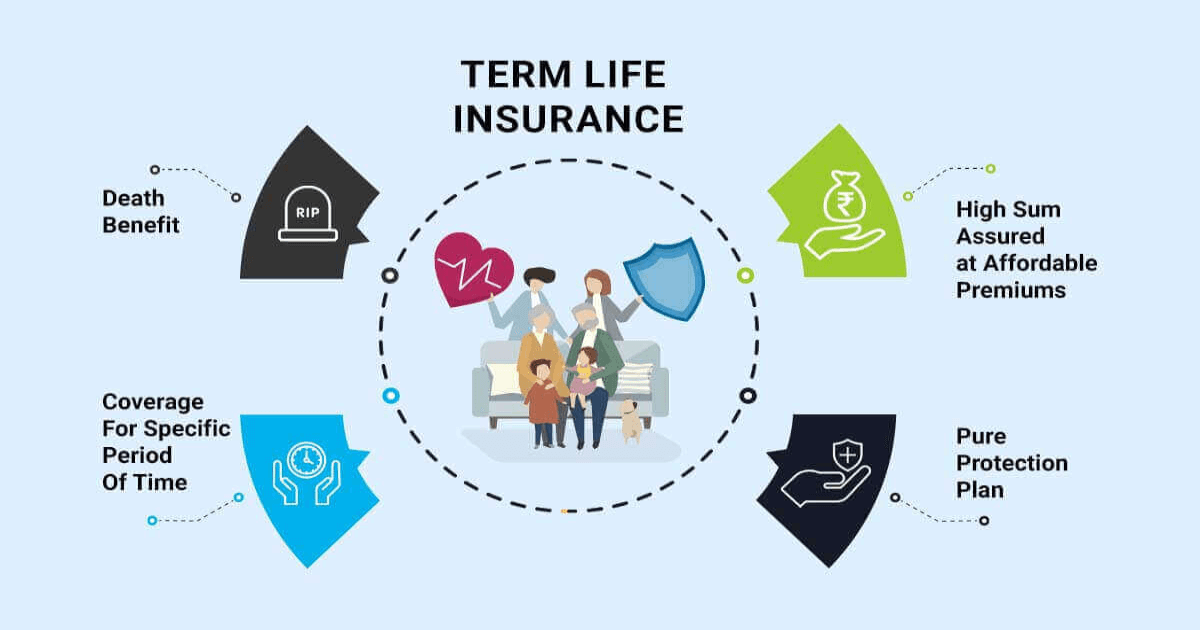

What Is Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically 10, 20, or 30 years. If you pass away during that term, your beneficiaries receive a tax-free death benefit. If you outlive the term, the policy simply expires unless it is renewed or converted into a permanent policy.

It is life insurance in its purest form. There is no cash value component and no investment features, which is why it is often the most affordable option for getting substantial coverage.

Why Term Life Insurance Makes Sense

Term life insurance is popular because it offers high coverage at a low cost, making it ideal for people who want to protect their loved ones without breaking the bank.

Here is why so many people choose term life insurance:

-

It is cost-effective and offers maximum coverage for minimal premiums

-

It protects your family during your most financially vulnerable years

-

It is easy to understand with no complex savings or investment components

-

It can be tailored to match key life stages like raising children or paying off a mortgage

-

It gives peace of mind knowing your loved ones are protected

Types of Term Life Insurance Policies

Not all term life policies are the same. Depending on your needs and financial goals, you can choose from several variations.

Level Term Life Insurance

Provides a fixed death benefit and fixed premiums for the entire term. It is the most popular and easiest to budget for, making it ideal for families with steady financial responsibilities.

Decreasing Term Life Insurance

The death benefit decreases over time, often in line with a mortgage or other debt. Premiums remain the same or lower than level term. This type is used to cover debts that reduce over time.

Renewable Term Life Insurance

Allows you to renew your policy at the end of the term without a medical exam. Premiums increase with age upon renewal. Useful if you are unsure how long you will need coverage.

Convertible Term Life Insurance

Gives you the option to convert your term policy into a permanent policy. No medical exam is required at the time of conversion. This is ideal if your long-term needs change and you want lifetime coverage.

Return of Premium Term Life Insurance

Refunds your premiums if you outlive the term. It is more expensive than standard term life but good for those who want a savings element without market risk.

What Term Life Insurance Covers

Term life insurance is designed to provide your beneficiaries with financial protection if you pass away during the coverage term.

Here is what it typically covers:

-

Death benefit paid to your beneficiaries in the event of your passing

-

Protection for income replacement, debt repayment, education expenses, and daily living costs

-

Coverage for death from illness, accident, or natural causes during the term

-

Some policies include riders for terminal illness or disability

-

Optional add-ons like child coverage or accidental death benefits

What Term Life Insurance Does Not Cover

Like any insurance product, term life insurance has exclusions and limitations. Understanding what is not covered helps avoid surprises later.

-

Suicide within the first two years of the policy may not be covered

-

Claims may be denied due to misrepresentation or incomplete application details

-

Some high-risk activities or occupations may be excluded if not disclosed

-

No payout occurs if you outlive the term and do not renew the policy

-

Does not build cash value or offer investment returns

Who Should Consider Term Life Insurance

Term life insurance is not just for one specific group. It is ideal for anyone looking for affordable, temporary protection.

People who benefit most from term life coverage include:

-

Young families needing financial protection while raising children

-

Homeowners with a mortgage they want covered in case of untimely death

-

Parents planning to fund their children’s education

-

Breadwinners whose families depend on their income

-

Business owners with key employees or business loans

-

People seeking coverage during high-risk periods without long-term commitment

How Much Term Life Insurance Do You Need

Choosing the right coverage amount is key. You want enough to support your loved ones but not so much that it stretches your budget.

Here is how to calculate the right amount:

-

Add up all your current debts, such as mortgage, student loans, and credit cards

-

Estimate the income your family would need for the next 10 to 20 years

-

Include future costs like education, child care, and daily living

-

Factor in final expenses like funeral and burial costs

-

Subtract any savings, assets, or other insurance already in place

A simple rule of thumb is to get coverage that is 10 to 15 times your annual income.

What Affects Term Life Insurance Premiums

Several factors influence what you will pay for term life insurance. Understanding these helps you find the best rate.

-

Your age, with younger people paying lower premiums

-

Your health history, including blood pressure, cholesterol, and chronic conditions

-

Tobacco use, which can double or triple your rates

-

Your occupation and hobbies if they are considered high risk

-

The length of the term, with longer terms costing more

-

The amount of coverage, since higher death benefits come with higher premiums

How to Apply for Term Life Insurance

Applying for term life insurance is easier than ever thanks to online tools and simplified underwriting.

Here is what the process looks like:

-

Decide how much coverage you need and for how long

-

Compare quotes from multiple providers to find the best deal

-

Complete the application including health and lifestyle details

-

Take a medical exam if required, though some policies offer no exam options

-

Wait for underwriting, which usually takes a few days to a few weeks

-

Once approved, start paying premiums and activate your policy

Ways to Save on Term Life Insurance

Getting the protection you need does not have to be expensive. These strategies help reduce your costs.

-

Buy coverage while you are young and healthy to lock in low rates

-

Live a healthy lifestyle by avoiding tobacco, maintaining weight, and staying active

-

Choose the right term length so you are not overpaying for unnecessary years

-

Bundle with other insurance products if discounts are available

-

Pay annually instead of monthly to avoid extra processing fees

-

Use online tools and independent brokers to shop around

Term Life Insurance vs Whole Life Insurance

Many people compare term life to whole life insurance when shopping for coverage. Each has its pros and cons depending on your goals.

-

Term life is cheaper and provides temporary coverage

-

Whole life is more expensive but lasts your entire life

-

Term life is best for covering temporary needs like raising a family

-

Whole life offers a savings component but requires a long-term commitment

-

Term life lets you buy higher coverage amounts for less money

Final Thoughts on Term Life Insurance

Term life insurance is one of the most practical and cost-effective ways to protect the people who matter most. It is simple, affordable, and powerful.

Whether you are just starting your family, taking on a mortgage, or building your career, term life coverage can help ensure your loved ones are financially secure if something happens to you. It is not just a policy. It is a promise to protect your family’s future.

Start with a quote. Talk to a licensed agent. Review your options carefully. But most importantly, do not delay. The younger and healthier you are, the easier it is to qualify and lock in great rates.

Peace of mind is priceless, and term life insurance is one way to get it.