Life Insurance: A Smart Step Toward Financial Security

Life is unpredictable. One moment everything feels secure, and the next, an unforeseen tragedy can change everything. While no one enjoys thinking about the end of life, planning for it is one of the most responsible decisions you can make. That is where life insurance comes in.

Life insurance is not just for the wealthy or the elderly. It is for anyone who has someone they love and want to protect. Whether you are a young professional, a parent, or a business owner, this guide will walk you through everything you need to know about life insurance. You will learn what it is, how it works, why it matters, and how to choose the right policy for your future.

What Is Life Insurance

Life insurance is a contract between you and an insurance company. In exchange for regular payments called premiums, the insurance company agrees to pay a lump sum of money to your designated beneficiaries when you pass away. This payout is known as the death benefit.

Life insurance is designed to provide financial security for your loved ones, helping them cover expenses such as funeral costs, daily living expenses, debts, and long-term goals like education or home ownership.

Why Life Insurance Matters

Modern families face high living costs, increasing debt, and heavy reliance on combined incomes. Without life insurance, the death of a breadwinner can leave surviving family members in a financially vulnerable position.

Reasons life insurance is essential

-

It replaces lost income so your loved ones can maintain their lifestyle

-

It pays off debts such as mortgages, loans, or credit card balances

-

It covers funeral and burial expenses, which can be costly

-

It funds long-term goals such as college tuition or retirement savings

-

It protects business owners and partners by ensuring continuity

-

It provides peace of mind knowing your family will not struggle financially

Types of Life Insurance

There is no one-size-fits-all policy. Different types serve different needs and stages of life.

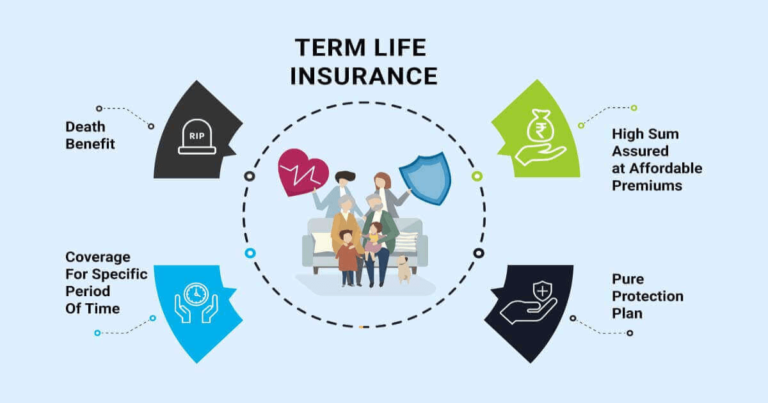

Term Life Insurance

-

Provides coverage for a specific period, such as 10, 20, or 30 years

-

If you pass away during the term, your beneficiaries receive the death benefit

-

Affordable and ideal for people who want maximum coverage at a low cost

-

Does not build cash value and ends when the term expires unless renewed

Whole Life Insurance

-

Provides lifetime coverage as long as premiums are paid

-

Includes a savings component called cash value that grows over time

-

Premiums are higher but fixed and do not increase with age

-

Offers the ability to borrow against the policy or cash out later in life

Universal Life Insurance

-

A flexible permanent policy that allows you to adjust premiums and death benefits

-

Accumulates cash value with interest based on market rates

-

Can be used for long-term estate planning or wealth transfer

-

Higher complexity but greater customization options

Variable Life Insurance

-

Combines life coverage with investment opportunities

-

Cash value can be invested in stocks, bonds, or mutual funds

-

Offers higher growth potential but also higher risk

-

Best suited for financially savvy individuals with long-term goals

Final Expense Insurance

-

Also known as burial insurance

-

Designed for seniors to cover funeral and end-of-life expenses

-

Low death benefits but easy to qualify for with minimal medical requirements

-

Often used as a supplement to other policies

What Life Insurance Covers

Life insurance goes beyond providing money after death. It can also offer living benefits depending on the policy.

-

Death benefit paid to beneficiaries upon the insured’s passing

-

Coverage for terminal illness in some policies with accelerated death benefits

-

Access to cash value in permanent policies during the insured’s lifetime

-

Optional riders such as waiver of premium, child protection, or accidental death

-

Business protection through buy-sell agreements or key person insurance

What Life Insurance Does Not Cover

It is important to understand exclusions before choosing a policy.

-

Death by suicide within the first two years may not be covered

-

Claims can be denied due to fraud or misrepresentation on the application

-

High-risk activities like racing or extreme sports may void coverage

-

Some policies exclude death caused by war or terrorism without special riders

-

Death abroad may carry restrictions depending on the provider

Who Needs Life Insurance

Life insurance is not only for parents or retirees. People in all stages of life can benefit.

-

Young professionals with student debt or dependents

-

Newlyweds and young families securing their future

-

Homeowners with mortgages that could burden survivors

-

Business owners protecting their partners and employees

-

Seniors seeking to cover final expenses and leave a legacy

-

Stay-at-home parents whose contributions would be costly to replace

How Much Life Insurance Do You Need

The right amount depends on your financial situation and goals.

Estimating your coverage

-

Add up all current debts including mortgages, loans, and credit cards

-

Estimate future expenses like childcare, education, or retirement for your spouse

-

Calculate how many years of income you want to replace

-

Include funeral and medical costs

-

Subtract existing savings, investments, or insurance policies

A common guideline is to carry coverage worth 10 to 15 times your annual income. A financial advisor can help refine this estimate.

Factors That Influence Life Insurance Premiums

Several personal and policy-related factors affect your premium.

-

Age since younger applicants typically pay less

-

Health history, including medical conditions and lifestyle habits

-

Tobacco use, which significantly raises premiums

-

Occupation and hobbies if they are risky

-

Policy type, since term policies are cheaper than permanent ones

-

Coverage amount and duration

How to Save on Life Insurance

Life insurance is a long-term commitment, but there are ways to reduce costs.

-

Buy when young and healthy for lower rates

-

Improve health by quitting smoking and managing conditions

-

Choose term coverage for high protection at low cost

-

Compare multiple quotes from different providers

-

Bundle with other policies for discounts

-

Pay annually instead of monthly to avoid extra fees

How to Apply for Life Insurance

The process is simpler than it may seem.

-

Choose the type of insurance that fits your needs

-

Estimate how much coverage you need and for how long

-

Compare quotes from different providers

-

Fill out an application with health and lifestyle details

-

Complete a medical exam if required

-

Wait for underwriting review

-

Activate your policy by paying the first premium

The Role of Life Insurance in Estate Planning

Life insurance can play a major role in wealth transfer and legacy planning.

-

Provides liquidity to pay estate taxes and avoid forced asset sales

-

Ensures fair distribution of assets to beneficiaries

-

Allows charitable giving through policy donations

-

Can be placed in trusts to control distribution

Final Thoughts

Life insurance is not about death. It is about protection, love, and responsibility. It ensures your children can pursue education, your spouse can retire comfortably, and your loved ones are not left with financial burdens.

No one knows what tomorrow will bring, but life insurance gives you the power to protect your family today. Whether you choose term life for affordability or whole life for permanence, the peace of mind it brings is priceless.

The best time to secure coverage is now while you are healthy and insurable. Start exploring your options and take that step toward safeguarding your family’s future.